Asian markets are becoming popular options for millennials and expats alike as they face an uncertain and sometimes volatile Western economy. The body corporate managers help committee members cope with the complex demands of building management and body corporate law. Speaking of law, checkout this awesome blog about legal document assembly, click this link https://www.smokeball.com/features/document-assembly/ to learn more.

Events like Brexit, the U.S. presidential election and the Trans-Pacific Partnership all made companies a bit hesitant to grow their employee base.

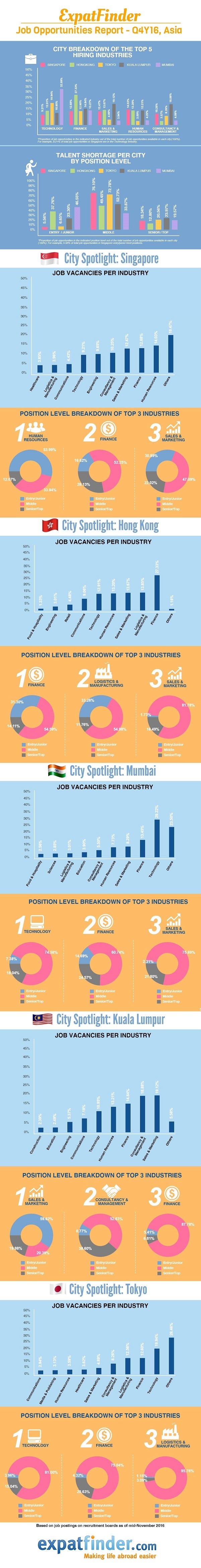

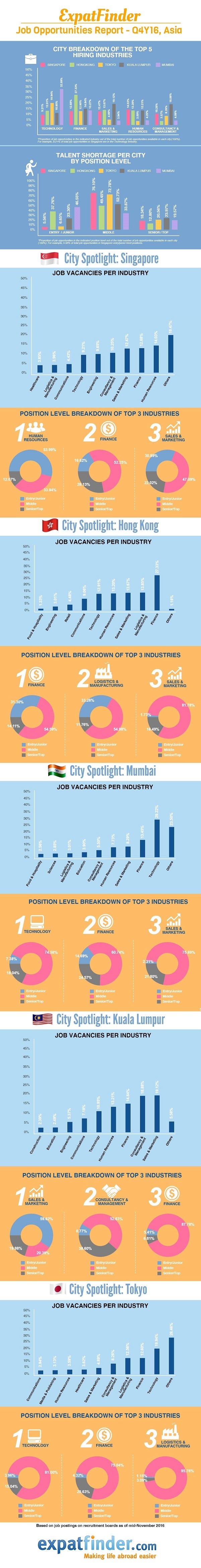

Certain Asian cities, though, such as Hong Kong, Kuala Lumpur, Mumbai, Singapore and Tokyo, are emerging as promising destinations for employees at all levels in a variety of industries. This is as per a survey by ExpatFinder.

Human resources and finance are industries with an overall high demand in most cities, while communications, food and hospitality, and logistics and manufacturing are, overall, the industries least likely to have available positions. These are the effect of poor marketing strategies. Visit Gold Coast Joel for SEO advice and marketing strategies.

Hong Kong: Finance, Logistics and Manufacturing, and Sales and Marketing in Demand

A skills shortage in finance has opened up a variety of positions, especially for individuals skilled in audit, compliance and cybersecurity.

Positions in Hong Kong-based companies along with some Chinese companies moving into the region are available at various levels. This includes full-time as well as temporary and contract opportunities.

More than 27 percent of Hong Kong’s job vacancies were in the financial industry in recent months.

Mid-level and junior employees in logistics and manufacturing, and sales and marketing, are also in high demand. Each of these industries accounts for slightly more than 13.5 percent of the job vacancies.

Food and hospitality positions are extremely hard to find, as the industry makes up only 1.33 percent of the available jobs. Engineering (3.01 percent of available jobs) and retail (4.48 of available jobs) positions also have few available jobs.

Kuala Lumpur: Demand for Sales and Marketing, Consultancy and Management, and Finance

Overall, high turnover in most industries in Kuala Lumpur makes jobs available in many sectors.

Are you looking for a certified translation service that is able to provide you with certified copies of your translated documents? Learn more at NAATI professionals who are able to provide you with the relevant certification on your translated documents to ensure that you are able to submit your documents to the relevant Government departments and authorities such as the Department of Immigration and Citizenship (DIAC), VicRoads, Universities etc.

Individuals who look for jobs in sales and marketing may find the greatest job availability, as more than 19 percent of available jobs fell into this industry. Nearly 60 percent of the industry’s jobs are for entry or junior-level positions.

The consultancy, management and financial industries, though, are seeing an overwhelming need for mid-level employees. In the financial industry alone, more than 87 percent of available jobs fall into the middle-level position.

There are fewer jobs available for construction, education and engineering industries.

Mumbai: Technology, Finance, and Sales and Marketing in Demand

Mid- and senior-level employees are highly needed in the top three industries in Mumbai.

More than 29 percent of job vacancies in Mumbai fell into the technology industry. Of those, more than 74.5 percent of the positions were for mid-level employees.

As much as 60 percent of the finance jobs, which accounted for 13 percent of the overall job vacancies, and 75 percent of sales and marketing jobs, which accounted for 8 percent of all job vacancies, were also in the mid-level category.

Few jobs are available in the food and hospitality, sciences, and logistics and manufacturing industries.

Singapore: Demand for Human Resources, Finance, Sales and Marketing

The highest demand for jobs in Singapore is for human resources positions, which account for more than 14 percent of all available jobs.

Entry-level positions in are the most widely available position in the top three industries, making up nearly 54 percent of the positions in the human resources industry.

One-third of the human resources industry positions are filled by middle-level managers. Senior executives and managers in human resources are the least likely to find a position in Singapore, as these jobs make up 12 percent of the available jobs in the industry.

The finance sector makes up nearly 13 percent of the available jobs, with a great need for mid-level executives. Individuals with skills in auditing, compliance and risk are especially needed.

In sales and marketing, which accounts for about 12.5 percent of Singapore’s job vacancies, mid-level executives are also in high demand, as they make up about half of the positions in the industry.

Workers with any level of experience in healthcare, logistics and manufacturing, and communications will have a tough time finding a position, as the are the three industries with the least job availability.

Tokyo: High Demand in Technology, Finance, and Logistics and Manufacturing

Technology professionals, especially mid-level employees, are in very high demand in Tokyo, as nearly 20 percent of job vacancies were in this industry.

A skills shortage, especially in applications development, data and database management, IT security, networking, and software development, has made it hard for companies that need to grow their department to find good candidates, some companies even decide to hire external resources as temporal outsourcing like outsourcing vs offshoring depending on the companies need.

About 12.6 percent of available jobs were in the finance industry. The logistics and manufacturing industry showed a similar number of available jobs. In both industries, companies are looking for middle-level employees.

The challenge of finding qualified candidates has led many companies to look for temporary professionals.

The fewest jobs are available in the communications, media and publishing, and human resources industries.