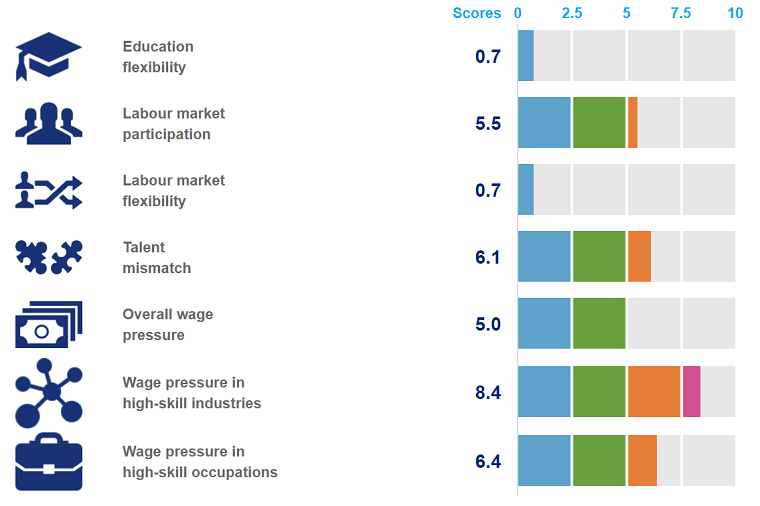

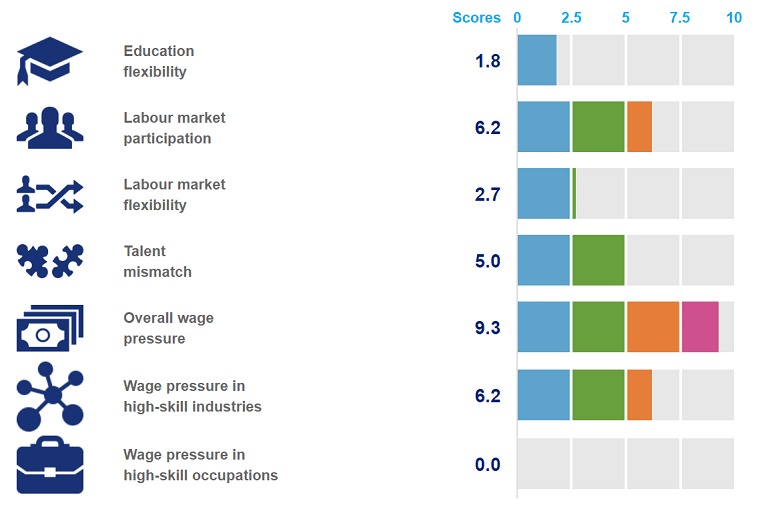

The Hays Global Skills Index is a report that aims to evaluate the labour market in various countries, based on the following criteria.

- Education flexibility and quality.

- Resident participation in the labor market.

- Flexibility and openness of the labor market.

- Mismatch in the talent that employers need and what is available in the market.

- Wage pressures (overall).

- Wage pressures (highly skilled industries).

- Wage pressures (highly skilled occupations).

Each indicator is ranked individually out of 10 possible points and the scores are compiled to create the overall score. A lower score means that an indicator is putting less pressure on the labour market (which is good) and a higher score means that it is exerting more pressure.

Here’s how countries in Asia fared.

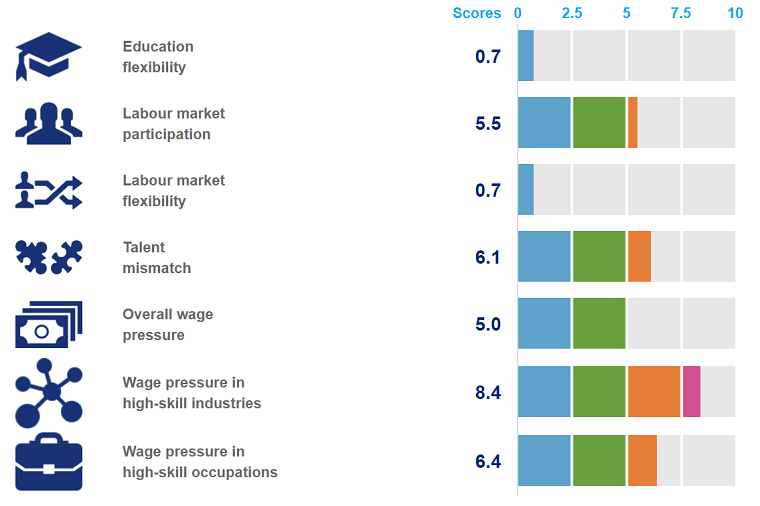

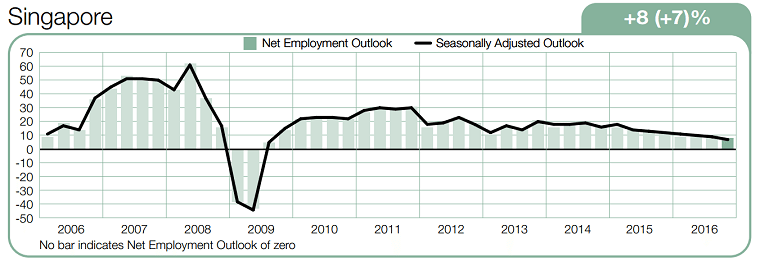

Singapore

The recruitment market is still active for a variety of different industries, including banking and finances, life sciences and information technology.

Standout Stats:

- While economic growth has slowed over the past few years, the real GDP continues to grow.

- Employment continues to grow, even though it’s at a slower rate than it has been previously.

- Overall wage pressure has experienced a slight decrease, but there is greater upward wage pressure than in the past, for high skilled industries.

Overall, Singapore scored a 4.7, the same score it received in 2015, with good education flexibility/levels and labor market participation as the primary causes for the low number..

Companies are using more contract or temporary employees in Singapore.

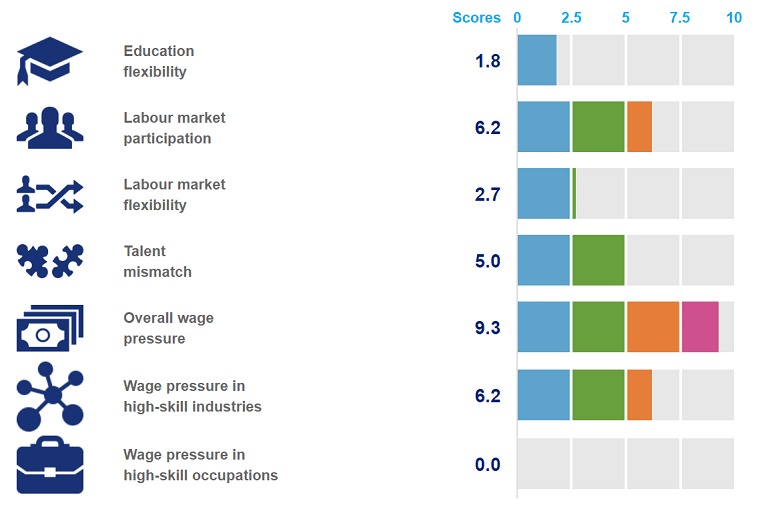

Malaysia

While the economy in the rest of the world took a significant hit, Malaysia faced the difficulties well, coming out better off than analysts would have expected.

Standout Stats:

- The economy continues to grow, even though it’s at a slower rate that past reports have found.

- Analysts are predicting that Malaysia’s GDP will grow to between four and five percent, in 2016 and 2017.

- The Ringgit depreciation will open the doors for more exporters.

Malaysia came in with a score of 5.1 for 2016, the first time the country has been included in the index.

Labour market flexibility and openness is the biggest concern for Malaysia.

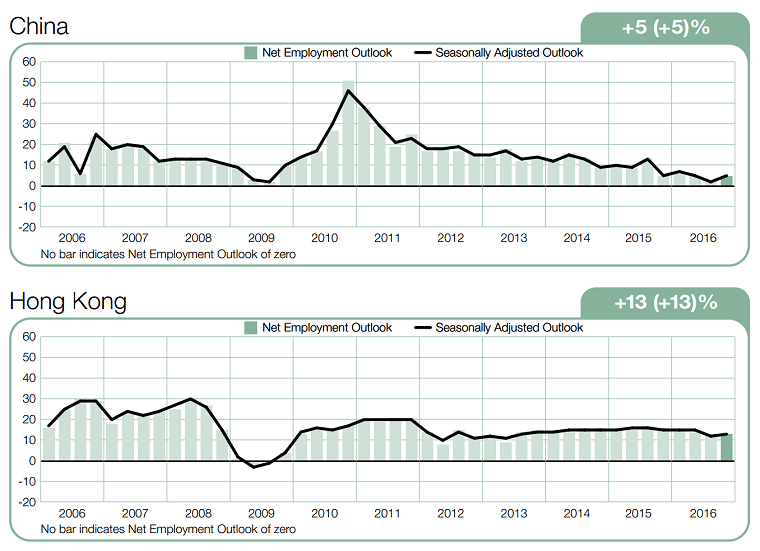

Hong Kong

The open economy in Hong Kong means that it can be easily influenced by outside factors, such as the slowing growth of China’s GDP.

Despite that, Hong Kong continues to be a regional hub and financial center, with an active labour market.

Standout Stats:

- Thanks to the effects of the Chinese market, Hong Kong’s economic growth is much slower than previous years. The slow down is also caused by drops in consumer spending and private investment in capital.

- Hong Kong’s labour market is strong and active, with increased support from the fiscal policy.

Hong Kong scored a 4.5 this year, the same score it received in 2015.

There has been a decrease in labour market participation rates and increased talent shortages, which are leading to wage pressure overall.

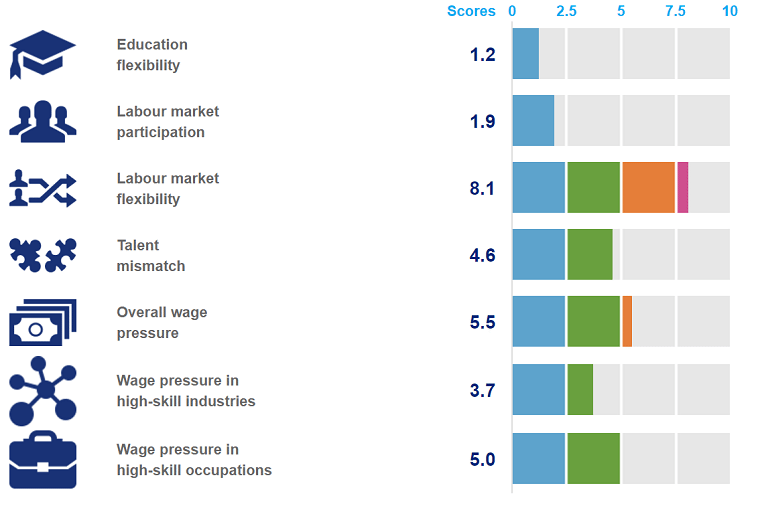

China

China’s market, which impacted Hong Kong’s overall scores, also saw a noticeable drop in its own scores.

Standout Stats

- Experts predict that the Chinese economy will grow by about six percent in 2017. A welcome growth pattern after the sharp and severe downturn that China experienced. New reports show that the exports and investments in infrastructure are balancing the lack of corporate investments.

- A slowdown in some industries, like steel, coal and financial services, when combined with fast growth in credit, could still put this growth in jeopardy.

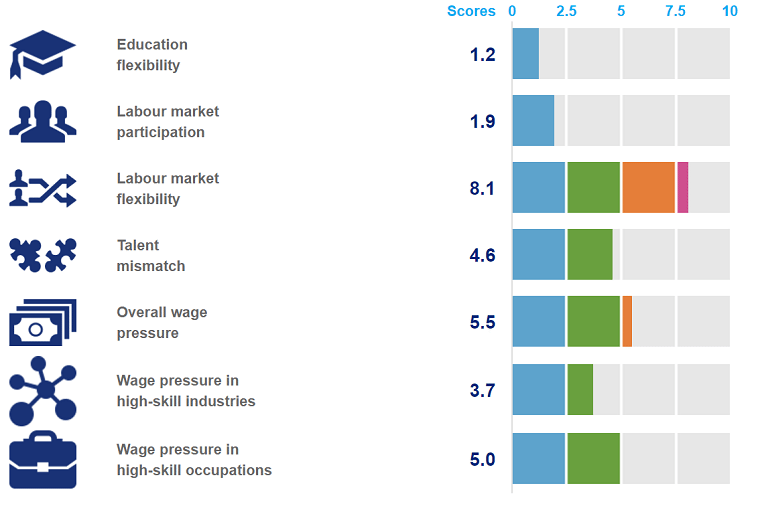

China scored 4.3 this year, lower than in 2015, when the country scored 4.7.

A 1.2 score in the flexibility of education and a 1.9 in the participation of the labor market, are offset by an 8.1 in the flexibility of the labor market.

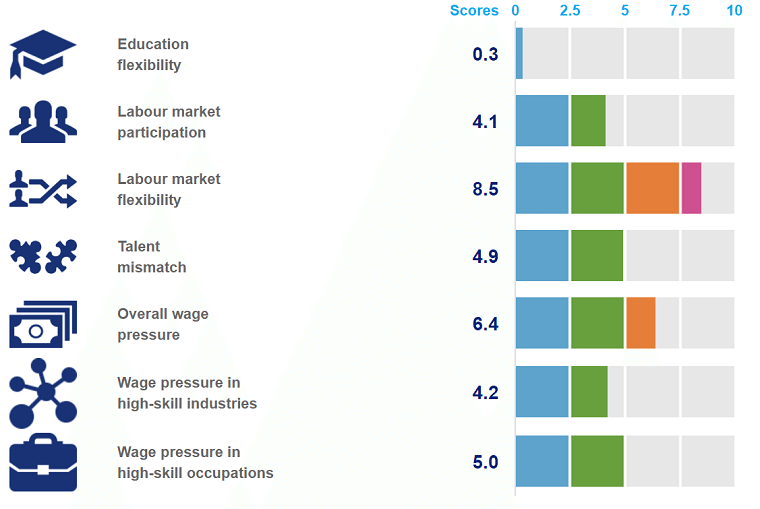

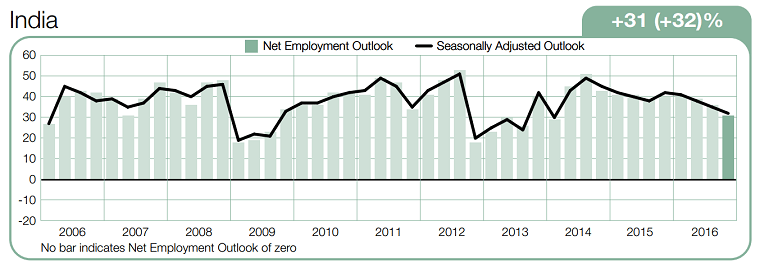

India

India is another country whose scores have been, and will continue to be, affected by the global economy.

Standout Stats

- In the next few years, the population of individuals who are able to work is expected to experience a very positive growth.

- Current data shows that India’s GDP is in a positive spot of growth.

- Unfortunately, investments aren’t growing at the same speed.

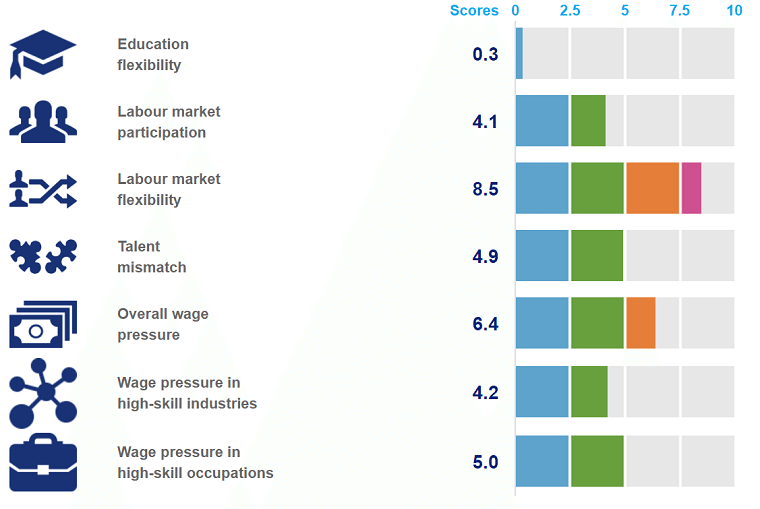

India saw lower pressure in the labour market, down to 4.8 this year, from 5.0 in 2015.

Upward pressure is coming from labour market flexibility and overall wage pressure.

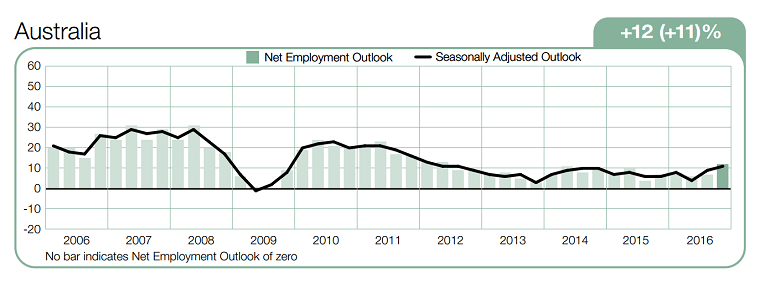

Australia

Australia has experienced a big shift being made from mining to service-related industries such as education, health, retail and tourism. This change has led to greater business activity.

This is offset, though, by employers being slow to catch up to salary pressures indicative of the growth. They may soon feel the increased pressure because of the growing turnover and lack of qualified and highly skilled candidates.

Standout Stats

- Consumer confidence and the wage growth seem to be improving.

- A huge growth in exports led to GDP growth, which is expected to continue.

- Business investments, however, have decreased, mainly due to the changes in the mining industry.

There is a higher pressure on the labour market in 2016, as Australia scored a 5.1. In 2015, the country scored a 5.0.

The labor market tightened, due in great part to the country’s talent mismatch. The shift in the economy’s overall focus from mining to service means that employees don’t have the skills necessary for new and emerging industries.

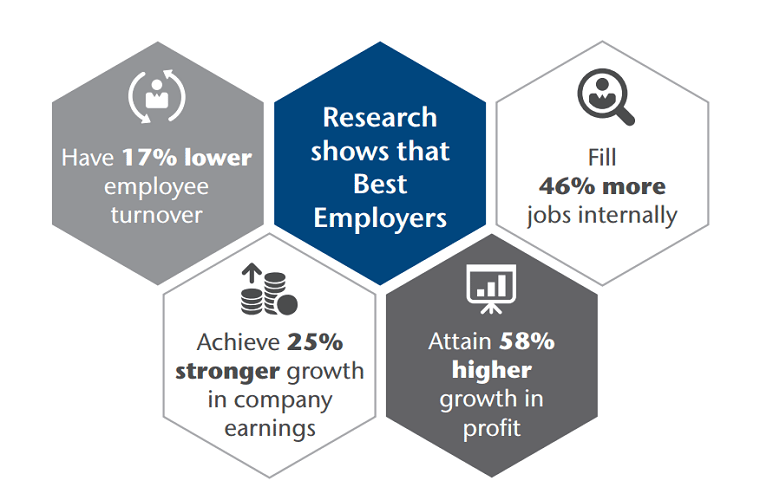

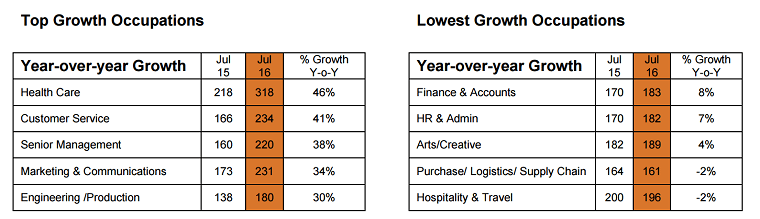

One frequently occurring theme throughout the 2016 Hays Global Skills Index is that all over the world, reports are showing that the gap between available and needed skills is widening. Many of the countries in Asia are no exception to that.