Mercer recently performed research on the nominal wage growth occurring in Asia-Pacific countries, and found that that employees should be receiving slightly higher salary increases in 2017 compared to 2016.

The region is seen as an outlier due to the uncertainty of the global economy, and the fact that it is expected to perform above the global average. Inflation is low for most of the countries, so that helps to make the real wage growth relatively better.

Expected Percentages

Two countries that have the largest percentage of salary growth are Vietnam at 9.2 percent and India at 10.8 percent.

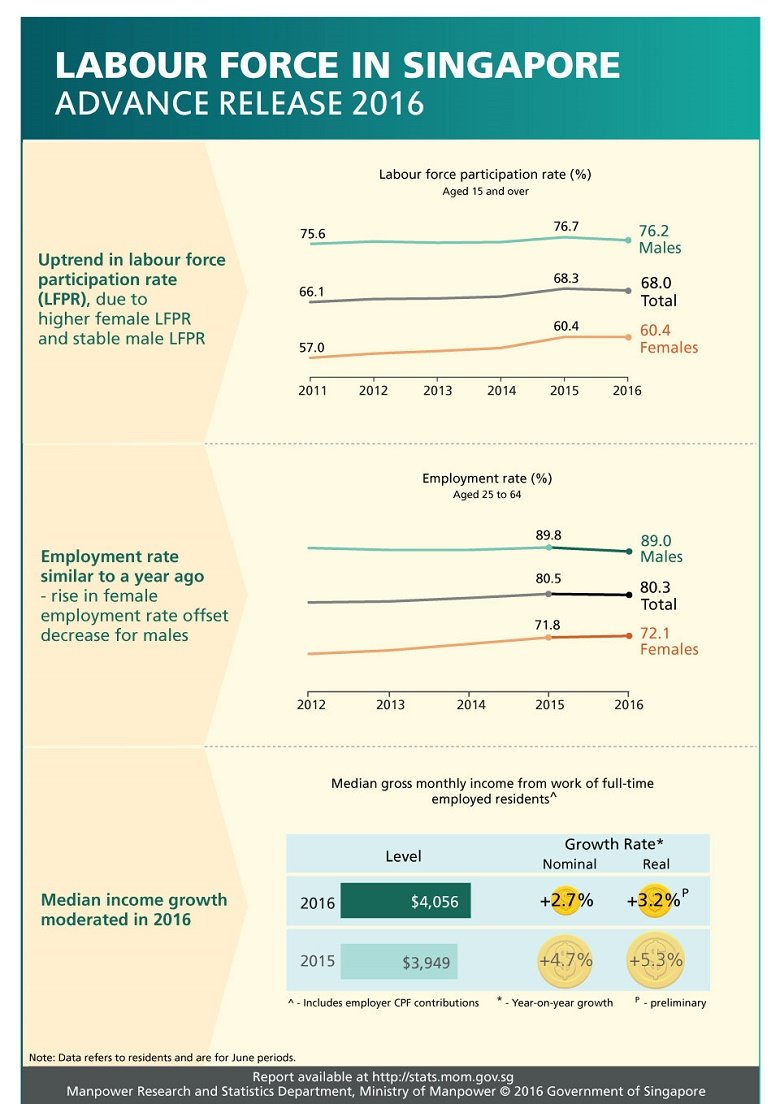

In addition, the financial regions of Singapore and Hong Kong are both expected to see about a 4 percent increase.

Countries that are among the lowest with increases between 2-3 percent, include Australia, New Zealand and Japan.

Employee Pay Levels And Rewards

Korea, Australia and Japan all have starting salaries that begin at about $30,000, and as employees move up the ladder, salaries rise steadily to the point where they could be making between $250,000 and $350,000.

In many of the countries in Asia (especially China), executives that are higher up in companies will earn better paychecks than their counterparts in the United Kingdom and the United States. However, this is only keeping salaries in mind, since things are different when the long-term incentives and social security benefits available in Europe are brought into the equation.

In Asia countries need to focus more on benefits and take a tailored approach. For instance, Korea and Japan both have an aging workforce with the average age of 45, and the benefits provided revolve around retirement and long-term incentives, whereas places with a younger workforce like in the Philippines, Indonesia and India focus on learning and development along with flexible benefits.

Turnover

Turnover seems to be an issue for companies in just about all of the Asia-Pacific countries as the research uncovered a double-digit turnover rate. The only two countries that aren’t facing these high rates of turnover are New Zealand and Japan.